SoFlo Funding

When searching for the best financial partners in the United States of America, SoFlo Funding will always come top on the list.

Financial Partner

If you are looking for a listening and caring financial partner in the United States, the answer is SoFlo Funding.

Loans

We offer a broad range of loans that will meet your needs with a high level of precision.

Business

We cater for a broad range of business needs regardless of the size and type of your business.

SoFlo Funding

Several companies in the United States offer loans to the citizens. However, not all of them have the best products for you as a borrower. You have to pay close attention to the terms and conditions of each company before you make an application. Of utmost importance are the interest rates, loan processing period, installment amount and frequency, and what will happen in case of default among other factors.

The best company to run to when in need of a loan in the region is SoFlo Funding. Besides, we offer the best interest rates and take the shortest time possible to process your loan. It means that we are a brand that you can trust in case in an emergency. Here are some of the top financing solutions that you will get from our company.

When searching for the best financial partners in the United States of America, SoFlo Funding will always come top on the list. Most people will tell you that the funding options that are available at this brand are just amazing.

The most important thing to us is the fact that you are running a legit enterprise. We will carry out a thorough business assessment an approve an amount that will add real value to your business operations. We have a long list of customers in the region who come to us for financial assistance. Therefore, you should not struggle when looking for a loan because we are your one-stop solution for all your financial needs.

Our company has a broad range of products and you will not fail to get the one that will meet your needs perfectly. It does not matter whether you need cash for school fees, business expansion, real estate investment, hospital bills, or buying a car among others. We have the best turnaround time and interest rates for all our products.

Here at SoFlo Funding, we love educating you on the funding process, whether you are a startup or an established business. So below are two of our preferred funding partners that we highly recommend. Fundwise Capital and David Allen Capital have provided the top funding solutions for thousands of entrepreneurs nationwide. You can read about them by clicking either of the two buttons below

Here are some of the top financing solutions that you will get from our company.

Startup Funding

Most financial institutions are reluctant to give loans to startups. The reason is that you are not sure whether the business will pickup or not. However, this is not the case when you choose to come to us for funding. All we need is for you to have a viable business idea and we will give you the funds.

Startup Funding for Business

Our company has the most flexible deals when it comes to startup funding for business. Our loan officers understand that over-funding and under-funding a startup is not healthy for its operations. Therefore, we approve loan amounts that are sufficient for your brand. It is the only way that you can take your brand to the next level with a lot of ease.

Startup Funding for Small Business

We are extremely careful when setting the installment amounts for startup small businesses. Since you are new in business, there is a high possibility that you will not understand your cash flows. Setting installment amounts that are too big will make you to strain in business or even fail. Our loan officers will make sure that you have affordable rates. It is better to clear the loan before time and make a new application than straining throughout the loan term.

Startup Funding Website

I have seen so many startups in the United States fail and one of the reasons is that they are unable to service their loans. The good thing with our company is that we are a caring partner and will not want this to come your way. If you are struggling, come to use and we can either re-finance or re-schedule the loan.

Startup Funding for Nonprofits

Very few financial institutions in the United States fund non-profit startups and we are one of them. All we need to know is the source of funds for your loan repayment and we will give you the money that you need. Therefore, don’t hesitate to visit us if you need some funding for your non-profit startup.

Startup Funding Companies

Are you planning to set-up and new company and capital is an issue? Don’t allow the lack of funds to be the reason that will prevent you from achieving your ambition in life. We finance companies that are starting up regardless of the company size or capital requirement. Just bring your business plan to us and we will be more than willing to partner with you.

Startup Funding Options

As a company, we have so many startup funding options for our customers in the United States. We have tailor-made products that will meet your needs depending on the size and type of your business. The loan amount, amount and frequency of installment, and payment mode all depend on the nature of your business.

Startup Funding Sources

There are so many places that you can get funding for your business startup. It can be from savings, friends, relatives, and other well-wishers. However, it is not easy to get such funds because most people are struggling financially. We come in with a reliable option of giving loans to startups. All we need to understand is your business idea and we will fund it fully.

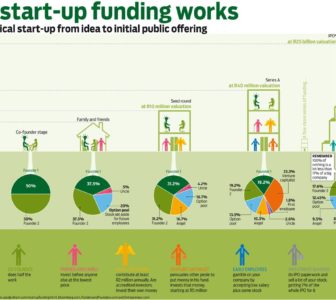

Startup Funding Stages

Unlike a running business, you will not have a clear picture of the cash flows for a startup. All you need to do is rely on speculation but this will not be far from truth as long as you know what you are doing. Therefore, the stages of startup funding tend to be more complex than when a business is running because you have to convince the financier that you have the ability to pay the disbursed amount and the interest. Some of the common stages include seed capital, angel investment funding, venture capital financing, mezzanine financing and bridge loans, and the initial public offers (IPO). We make the whole process easy by giving you a less complex process when applying for startup loans.

Startup Funding Online

Our company has the option that allows you to apply for startup funding online. All you need to do is create an account on our website and make an application. It takes a very short time to process your application, approve the loan.

How Startups Get Funding

If you are planning to start a new business, there are so many sources of funds that you can use. It can be your savings, IPO, contribution from family and friends or crowd funding among others. Our company comes in handy to give business loans to any viable startup in the region.

Business Funding

As a business, we offer the best interest rates and most flexible payment options for businesses in the United States. The loan amount and repayment terms virtually depend on the size and type of your business. We understand that it is the business to repay the loan and we do all that we can to give you the best.

Business Funding for Startups

It is hard to run a business without sufficient funds. Struggling financially will lead to a high level of dissatisfaction and lose of trust from customers. The effects can be more if you are a startup as you will be striving to create a customer base. Avoid such disappointments by coming to us for business funding for startups.

Business Funding Solutions

We offer the best business funding solutions in the region. We tailor our products in such a way that they match your business needs. It means that you will not strain as you continue repaying your loan.

Business Funding with Bad Credit

Having a bad credit history does not mean that you have are a bad person. Several reasons can lead to blacklisting and some of them are unavoidable. Our loan officers analyze each situation to help you get a business loan even if your credit history is wanting.

Business Funding Fast

There comes a time when you need business funds very fast lest you miss out on the opportunity. Our team takes the shortest time possible to process the loan request so that you can get the funds within the shortest time possible.

Small Business Funding

If you own a small business, you can turn to use for funding. You can be sure of getting the necessary financial support from us even if other lenders are not willing to help you. Besides, we will give you tips to help you take your business to the next level.

Business Funding Partners

Financial institutions are among the best business funding partners that you can think about. If you want a reliable partner, no one is like us. We will supply the funds when you need them most and at the best rates.

Business Funding for Veterans

We offer the best business funding for veterans in America. The company takes a shorter time to process the requests and give veterans better rates than the ordinary citizens.

Business Funding Group

The best business funding group is at SoFlo Funding. You stand to learn so much when you become a member of this great financial institution. Apart from giving you the money to run your business, you will learn so many tips from us and other entrepreneurs to help you succeed in business.

Business Funding Capital

Lack of capital can do a lot of de-service to your brand. If you don’t have sufficient funds to run your business, you can come to us for funding.

Small Business Loans

Most small businesses struggle to get capital because lenders don’t believe in their ability to grow. Our company is different because we have so many multinationals that started as small businesses under our support and you can be one of them.

Small Business Loans for Woman

If you desire to become a successful business women, we are here to hold your hand. Our loan officers will give you all the money that you need to grow your small business.

How to Get Small Business Loans

It is not hard to get small business loans as long as you know where to start from. Come to use and you will get these funding opportunities with minimal hassle.

Small Business Loans for Startups

The main problem that eats up startups in America is the lack of sufficient funding. The challenge is that very few investors will be ready to trust you with their money. There is no need to worry because we give you the money that you need to put in your business and grow.

Small Business Loans for Veterans

We have veterans who run small businesses to earn a living and keep them busy. Our institution gives such people special loan products so that they won’t strain in paying them.

Small Business Loans Rates

The loan rates for small businesses vary from one financial institution to another. Since we know that your ambition is to grow, we will give you the best rates to help you save more and increase your working capital.

Small Business Loans Near Me

For small business loans, it is good to go for a lander who is near you. Our company is willing to walk with you through this path until you become a successful entrepreneur.

Rates for Small Business Loans

We offer the best rates for small business loans in the region. As a caring financial partner, we give you rates that will promote business growth.

Small Business Loans for Minorities

Minority groups have a challenge of securing business loans because of their limited capacity to pay. As a company, we value these people and hence give them small business loans.

How Do Small Business Loans Work?

Your small business should be able to meet the loan installment of the money that you pump in it. We always begin with small amounts and increase as your business continues to grow. Also, we set the number of instatements that will not be too burdensome for the borrower.

Small Business Loans New Business

Are you planning to start a new small business? Come with your proposal to us and we will give you the funds that you need most.

Small Business Loans Online

There is no need to do a lot of documentation yet all you need is a small business loan. Make your loan application online through our website and we will disburse the amount to you.

Small Business Loans for Disabled Veterans

Disabled veterans need special attention when applying for business loans. These are people who have suffered by sacrificing for our nation. We value them and hence disburse very cheap loans to help them in running their businesses.

Qualifications for Small Business Loans

The most important thing that will qualify you to get a small business loan is your ability to pay. However, we will also look at your credit history, nationality, business records, license, and location among others.

Small Business Loans Unsecured

You can get unsecured business loans for your small enterprise by shopping with us. You can get access to bigger loans as your business continues to grow and as you acquire assets to help you get secured loans.

Where to Get Small Business Loans

Most lenders in the United States are hesitant to fund small business owners. What they could not be knowing is that even the large corporations started as small businesses. Don’t be stressed if you are looking for a place to get a loan for your small business. You can be sure that we will give you the funding that you need most for your business.

Small Business Loans Quick

One good thing about our company is that we take the shortest time possible to process small business loans. Therefore, we will not let you down especially if you have an urgent order.

Small Business Loans Companies

When running a small company, you may find it difficult to get working capital. If your customers, suppliers, investors and other stake holders discover that you are straining, they may shy away from doing business with you. To avoid this, give us a call so that we can give you the money that your small company needs most.

Small Business Loans Amount

The loan amounts that various lenders give for small businesses vary. It is good to no that both overfunding and underfunding a small business is not healthy for its operations. It explains why we take a flexible approach when funding your small business. Our loan officers evaluate the ability of your small business to re-pay the loan before approving any amount.

Unsecured Loans

Unsecured loans don’t require the borrower to provide a collateral to cover the loan in case of default. Most lenders are very reluctant to give out these loans to borrowers. In most cases, you will need a high credit score to access such loans. We are your number one brand of choice of you are shopping for secured loans in the region.

Unsecured Loans Personal

In most cases, those people who have a pay slip get access to unsecured personal loans. You will not require an additional collateral like a logbook or title deed to access such a facility. SoFlo Funding will give you personal loans depending on your ability to pay and magnitude of your need.

Unsecured Loans vs Secured

With secured loans, you will always need a collateral to back up the facility. This can be a land title deed, log book, or any other document that shows you are the legal owner of the asset. It means that the lender will have a fallback in case you fail to service your loan. However, you still need to portray the ability to meet the loan installment before getting a secured loan.

On the other hand, unsecured loans don’t want the borrower to back them up with a collateral. In most cases, they are for those people who have a stable income like a pay slip or high credit scores.

Unsecured Loans for Business

It is not hard to get an unsecured loan for your business as long as you choose to check with our company. We have several products under this category and you won’t fail to get the one that is a perfect match for your needs. Therefore, there is no need to worry if you don’t have a collateral to secure your loan. The only thing we want from you is displaying the ability to repay your loan.

Unsecured Loans Online

Did you know that you can access our unsecured loans online? After registering on our website, you can make an application for unsecured loans and we will process it online. We have taken the process of applying for secured loans to the next level by accepting online applications.

Unsecured Loans Debt Consolidation

One of the best ways to improve your credit score is consolidating all your debts into one. You stand a chance to benefit a lot especially if you have so many small loans that are defaulting. Besides, consolidating your loans and remaining with a single installment makes the debt more comfortable to the borrower. Come to us if you want to consolidate all your debts into one unsecured loan.

Unsecured Loans to Consolidate Debt

It is a stressful experience to have so many small loans that fall due on different dates. You may not even know which loan is due on what date. At the end of the day, such facilities can end up giving up giving you a very poor credit score. Our company gives you an opportunity to consolidate all these debts into one unsecured loan.

Unsecured Loans Rates

In most case, unsecured loans tend to have higher interest rates. Most lenders will tell you that these loans carry a high level of risk since they have no collateral to back them up. Currently, we offer the best rates in the market for unsecured loans.

Rates for Unsecured Loans

It is more expensive to take an unsecured loan than a person who chooses to secure the loan. However, if you don’t have a collateral, it is the only way to go. You can get cheaper rates for unsecured loans by taking them with us.

Unsecured Loans Near Me

When taking unsecured loans, it is easier to get them from a financial institution that is close to you. Most lenders will trust you if you choose to go for unsecured loans near me. You won’t have any problem if you choose us to be a lender of your choice.

Unsecured Loans Interest Rates

You should have been hearing that unsecured loans come with very high interest rates. Even though this is true for some lenders, the case is different with us. Our costs for unsecured loans are lower than what other players in the market offer.

Unsecured Loans for Veterans

Veterans are highly respected in the United States because they are our heroes. It explains why we choose to give this group of individuals unsecured loans at very cheap. If you fall under this category, don’t hesitate to come to us for great deals.

Unsecured Loans Types

The market has different types of unsecured loans and it all depends on how you will be using the loan. You can pick one for business, school fees, house equipping, home renovation, and many more. Our company will give you access to all these products as long as you display the ability to pay.

Unsecured Loans Best Rates

Before taking unsecured loans, you have to compare the rates that different financial institution offers. Our company will give you these loans at the most competitive rates in the market.

Unsecured Loans Low Interest

If you are looking for unsecured loans at low interest rates, you need to come to us. We care about out customers and hence give them the best rates for unsecured loans.

SoFlo Funding is your number one source of funds for working capital and other needs. Currently, we offer the best interest rates and have an amazing turnaround time. We are a brand that you can trust even during emergencies.

Unsecured Loans Companies

Even though we have so many unsecured loans companies in the United States, not all of them are good for your consumption. Some financers will tell you that unsecured loans carry a high level of risk as a justification for high interest rates. However, this just tells you that they have not done proper KYC. You will rarely come across our personal loans defaulting because we do our due diligence.

Creative Financing

Creative financing is an uncommon or non-traditional means of buying property or land. The primary objective of creative financing is financing or purchasing a property. The investor or buyer puts in very little money but will still be able to acquire the desired asset. It is one of the best financing options that we have at SoFlo Funding.

Creative Financing Options

Not all the people you see owning property or land in the United States had enough money to buy or take a mortgage. With our creative financing option, you need a very little down payment to qualify for this loan. We have helped so many people in the United States to acquire property using this financing option.

What is Creative Financing

Creative financing is an unusual or innovative way of structuring loans which allows the borrower to purchase a land, home, or any other major item. Even a person who has a bad credit history can use this option to buy a real estate. The repayment plan is unique so as to meet your cash flows.

Creative Business Financing

There comes a time when you have no choice but to look for business expansion funds. If you run out of options like friends and family, going for a loan would be the best choice. However, you may discover that you don’t qualify for a loan from the traditional bank financing. It can be frustrating and time consuming to get a lender who will finance your business. The best thing to do is come for our creative business financing that pays close attention to your current cash flows.

Creative Financing Ideas

There are a few tips that will guide the lender when processing a creative loan for you. This includes the amount of cash you need for working capital, when do you need it, how will you use it, how will you repay, and what collateral will secure the loan. All these ideas will help us to give you the right amounts for creative financing.

Creative Financing Strategies

We use several strategies when it comes to creative financing. Each approach is unique depending on your personal needs. The guiding principle is to give you a loan that will help you in a situation where you don’t qualify for a traditional loan.

Creative Financing Solutions

Not all lenders in the United States will be able to advance you a creative loan. Some of them will give you these loans but their terms will not be very favorable to you. We apply a more flexible approach in designing these financing solutions so that you are comfortable as you continue servicing the loan.

Real Estate Investor Loan

Most real estate investors go for loans to fund their business ideas. It is hard to get a person who has such a large amount of money to build a real estate. Our company will give you a longer grace period and a more flexible repayment schedule when you apply for a real estate investor loan.

Real Estate Investor Financing

Most real estate projects cost a lot of money and you have no alternative but to go for real estate investor financing. In most cases, these loans run for a period of more than ten years. Since these loans have a collateral, they tend to have lower interest rates. The best place to take such loans in the United States is SoFlo Funding.

New Venture Funding

It is not easy to secure a loan for your new venture in the United States. Most lenders find it hard to determine your cash flows because you are not yet in active business. It means that calculating the affordable installment for a new venture is quite challenging. No wonder you will find most lenders asking for a collateral to act as a fall back. The good thing with our brand is that we don’t complicate the process for anyone who wants funding for his new venture.

Secured Loans

Secured loans is a great funding option because you will be having a collateral backing up the loan. It allows you to qualify for higher loan amounts and increase the level of trust that the lender has in the borrower. In most cases, the interest rates for secured loans are normally lower than the unsecured ones.

Secured Loans Online

It is possible to get secured loans online as long as you complete the application process and submit all the required documents. The company will verify your details online, sanction the loan, and disburse it within the shortest time possible.

Secured Loans for Bad Credit

It is very easy for a person who has a bad credit history to get a secured loan. You will be giving the lender a collateral to seize just in case you fail to pay. It is a clear indication that you are willing and able to pay for your loan. Our company has the best rates for anyone who wants secured loans but has a bad credit history.

Secured Loans with Bad Credit

The fact that you have a bad credit history is not an indication that you cannot get a loan. You can increase the possibility of getting a loan by providing a collateral. It will help you to avoid paying high interest rates that are normally associated with people with a bad credit history. When you pay your loan well, it will help you to improve your credit score hence get access to unsecured loans.

Secured Loans for Business

If you have some assets, you can use them to secure a business loan. It is a good way to get large amounts of loans for business expansion. The most important thing is to make sure that the asses will cover the loan comprehensively. However, you still have to display the ability to repay the loan.

Your business should have the capacity to repay the loan because it is not the intention of the lender to dispose off your asset to repay the loan. The collateral should just display your commitment to meet your financial obligation.

Secured Loans vs Unsecured Loan

It is easier to get a higher amount of a secured loan than a non-secured one. The lender will trust you more when you provide a collateral to cover the loan. As a result, secured loans tend to attract less interest rates. However, the processing period for secured loans may be longer because you have to perfect the assets using the right legal procedure.

Secured Loans Rates

The rates of secured loans are always lower because there is a fall back in case of default. It explains why most genuine borrowers prefer to secure their loans.

How Does Secured Loans Work?

When taking a secured loan, you have to provide an asset to the lender as a sign of your commitment to pay. It can be a logbook, title deed, or any other collateral. The most important thing is to proof that you are the real owner of the asset. If you are not the owner of that asset, the true owner has to consent in signing.

Secured Loan Debt Consolidation

The best way to consolidate your debt is to take a secure loan and pay off all the other loans. It will become very easy for you to manage your loan if you are paying only one loan. Besides, you stand to save a lot of money in the form of the accumulated interests.

Secured Loan Collateral

Several assets can be used as collateral for secured loans. However, the most common ones are land title deeds and logbooks. If you have any of them, you can use to secure a loan. You can also visit the lender to see the assets that he accepts as collateral for loan.

Secured Loans Types

There are different types of personal loans depending on the type of your income, amount of income, the purpose of the loan. You can get all these loan products from our company at very competitive rates.

Startup Business Loan Bad Credit

Our company has been on the leading end when it comes to funding people who have a bad credit score to start a business. You can increase the possibility of getting a loan and even the loan amount by providing a security for the loan.

Startup Business Funding

Loans are among the best places to get startup business funding. Since you don’t have active cash flows, you can increase your possibilities by providing a collateral. It gives the lender the assurance that you have the commitment to pay your loan.

Business Funding for Startup

Our institution offers the best options for funding startup businesses. From experience, we can speculate and forecast the future cash flows for your business venture. It helps us to tell the most appropriate loan amount for your business.

Startup Business Loan Rates

The loan rates for startups tend to be higher because of the risks that are involved with these businesses. However, our company offers the best rates for these loan types. You can reduce these rates further by giving us a collateral.

How to Get Startup Business Funding

The process of getting startup business loans is quite similar with the other types of loans. You need to submit an application and the lender will assess before approving the most appropriate amount.

SBA Loans

Small Business Administration helps you to guarantee loans to start and expand your business. We are one of the lenders in the United States who give you access to SBA loans.

SBA Loans Requirements

SBA works closely with lenders to give small businesses loans. However, this agency does not fund small business owners directly. All it does is to set the guidelines for the loans that its partners give to borrowers and the guarantees them. It reduces the risk for lenders and gives small business owners easy access to funds.

SBA Loans Rates

The interest rates for SBA loans are much lower because the guarantee that the agency gives to the lender on behalf of the borrower. It is a low risk loan that you need to take advantage of.

SBA Loans 504

The 504-loan program helps small businesses to expand, purchase, or replace heavy equipment or real estate. It helps these entrepreneurs to get to heights that they would not have otherwise achieved.

SBA Loans Disaster

If you are facing any form of disaster, you can always apply for SBA loans. All you need to do is confirm whether the loan product covers the kind of disaster that you are facing.

SBA Loans for Veterans

Veterans can also get special loan products that are guaranteed by Small Business Administration from our company. The terms for these loans are much better than any other product that is in the market.

SBA Loans for Women

It is much easier for women to get SBA loans and they come with more benefits for the female gender. Why pay more when you can get better deals in these loans.

SBA Loans Business

The number of people who are going for SBA business loans in the United States is on the rise. The agency can guarantee you even if you have a low credit score.

SBA Loans Interest Rate

Most people love SBA loans because they are relatively cheaper than the other types of loans. The agency agrees with the lender to charge less interest rates because it guarantees them hence minimizing the chances of default.

Terms for SBA Loans

The terms of the SBA loans are always set by the Small Business Administration Agency. In most cases, these conditions prevent any form of exploitation of borrowers by lenders. The lender has to adhere to the regulations before disbursing such loans.

SBA Loans Real Estate

Small business owners can access SBA loans to use in buying real estate. It is an excellent option because most small business owners cannot afford such a property unless they get more favorable terms.

SBA Loans Types

There are different types of SBA loans and you can apply all of them at SoFlo Funding. You can use these loans to buy real estate, purchase fixed assets, business expansion, cub the effects of an economic disaster, and many more. It is good to confirm whether SBA covers your needs and take advantage of these opportunities.

SBA Loans for Small Business

SBA loans are specially designed to help small businesses attain heights they would otherwise not be able. The agency guarantees you so that the lender can give you high loan amounts at very low interest rates. This facility has helped so many small businesses to grow into corporates.

SBA Loans Programs

The SBA loans programs are quite flexible in comparison to the other types of loan products. It is one of the best things that ever happened to the citizens of the United States. If you don’t have assets to secure a loan, SBA will come in to your aid.

SBA Loans Application

The application process for SBA loans is not a hard one. If you meet the criteria, the lender will not take long before approving the loan. You have to fill all the documents that both the lender and SBA requires to give you the loan.

MCA Loans

Merchant Credit Card are always given to businesses in exchange for future debit card and credit card sales. The lender evaluates how you have been selling through credit cards before giving you such a loan.

MCA Business Loans

If you are in business and accept credit card payments, you can get a loan from us backed by your credit card sales. Once we assess how much you have been getting from credit cards, we will disburse a business loan against it.

Merchant Cash Advance

The demand for merchant business loans in the United States is on the rise. It is one of the credit options that we use to fund our business customers.

Merchant Cash Advance Companies

Even though there are so many merchant cash advance companies in the region, we are the best of them all. The loans that we give to you come at competitive rates that you cannot find with any other lender in the market.

Merchant Cash Advance Loan

Are you are shopping for merchant cash advance loans? There is no need to worry because our company has the best offers for this category of customers. You will get amazing products at the most competitive rates in the region.

What is Merchant Cash Advance

We have so many people who don’t know what merchant cash advance is. As you know, a merchant is a retailing store that accepts point of sale devices such as credit cards. We evaluate your cash flows for debit and credit cards and advance you a business loan against it. This is what is referred to as merchant cash advance. The assumption is that the funds that you get from these merchant services is what will be used to repay the loan.

Merchant Cash Advance Bad Credit

If you have a bad credit, you can still get a merchant cash advance. Remember we are assessing your cash flows and not the credit history. Therefore, don’t shy away from making an application if you have a bad credit. The most important thing it for you to demonstrate the ability to repay your loan.

Shark Loans

Shark loans are entities that offer loans at very high interest rates and uses violence and threats to collect the debt. The interests are usually above what the market has set as legally acceptable.

Shark Loans Online

If you are looking for shark loans, you can get them from us online. Our company takes the shortest time possible to process your request.

Shark Loans Bad Credit

Shark loans serve you quite well when you are in a state of emergency. The lender can take even an hour to process these loans. Even though the interest rates for these loans are a bit high, they will save you a great deal. You can use the loans for any purpose whether business or meeting your personal needs.

Funding for Companies

For a company to grow, you will need funding from various investors. If you are not sure of the best starting point, feel free to come to us for a loan. We have the capacity to fund your company regardless of the loan amount that you need.

Funding Companies

SoFlo Funding is the best option for any company that is facing liquidity issues in the region. Once we understand your needs, we will be able to provide the most appropriate financial solution.

Funding Companies for Startups

As a company, you can have customers but lack sufficient funds to supply the desired goods and services. Such a thing can paint your company in the bad light. We have so many companies that have lost their reputation because if this. Financial struggles will make you lose current and potential customers, suppliers, investors, and other stakeholders. The case can be worse if you are in the initial stages of your company. Avoid such struggles by securing working capital from our company. We have enough finds to meet your cash flows needs whether small of big.

Funding for Small Companies

The main challenges that small companies face in the United States is the issue of funding. You may not have access to the best loan products because of limited cash flows. If such a condition persists, it can compromise the level of service delivery. One of the reasons for our existence is making sure that small companies don’t suffer from liquidity issues. We have special offers that will make your small company to grow within no time.

Business Lines of Credit

A line of credit works in a similar manner like credit cards but it is specially designed for small businesses. You can draw and use the available funds as long as you don’t exceed your limit. Most small entrepreneurs love it because it offers a high level of flexibility than the regular business loans.

Lines of Credit for Business

We have the best lines of credit loans for small business owners. We set a limit that you can borrow up to depending on your ability to pay. We charge you interest according to the amount of money that you pay for that particular period.

Lines of Credit Loans

We have a long list of customers who come for our lines of credit loans. Once we score a customer, he can be able to access the loan at and time and from any place. This high level of flexibility is what makes most small business owners in the United States to prefer lines of credit loans over the other regular funding options.

Lines of Credit Personal

Once you have our lines of credit, you can access the funds for personal use. The interest rates are affordable and we only charge you for what you consume within that period. The most important thing that you need to understand is that you cannot exceed the limit.

Lines of Credit for Small Business

Most of the small businesses in America rely on lines of business for funding. It is always good to have one even if you feel that you don’t need the funds now. After all, you won’t be charged any interest unless if you don’t use the available resources. The interest that you pay also depend on the amount of loan that you take. These lines of credit come in handy especially when you have a financial need that you need to meet with immediate effect.

Lines of Credit Online

Did you know that you can apply for lines of credit online? If not, come to us and you will get this amazing opportunity. You don’t have to come to our office to be able to get this product. You can visit our website and drop an application for the lines of credit. It will take us a very short period and we will process this product for you.

How do Lines of Credit Work?

The way lines of credit work are quite similar to the operation of credit cards. The only difference is that this product is specially designed for use by small businesses. The lender will assess your ability to pay and them set a limit for you. The funds will be readily available for you to use as per your demand.

Equity Lines of Credit Rates

Like credit cards, the rates of lines of credit are slightly higher than the ordinary loans. It is something that you need to understand because these products come with a higher level of risk. However, we still charge the most competitive interest rates in comparison to what the other service providers in the market will charge you.

Lines of Credit Rates

The good thing about lines of credit is that you have a high level of control on when you take the loan. All the lender does is to give you a limit depending on your current credit score. The number of loans that you have also affect your limit. Because of this high level of flexibility, you expect the rates of lines of credit to be slightly higher than the other loans. However, you can still get amazing rates by consuming our services.

Interest Rates for Lines of Credit

Even though the interest rates of lines of credit is slightly higher, the amount is readily available for the borrower upon need. It is a loan product that comes in handy especially when you need the funds as a matter of urgency.

Lines of Credit vs Loan

There is a clear line between lines of credit and loans. The lines of credit are highly flexible and once you get a limit, you can access the funds at any time. Once you pay, you will get back your money to your limit and you can re-borrow. However, these loan facilities come with a higher interest rates than loans. The good thing is that you will get the money from the lines of credit as soon as you need it.

How to Get Lines of Credit

If you want to get a line of credit, the first thing that you need to do is get a lender who offers this product. Get to understand their terms and conditions and whether you qualify. From here, you can submit your application and it will be processed within no time.

Business Lines of Credit Rates

The rates of business lines of credit are not as high as you may be thinking. We are the game changer in the market by providing these loan facilities at very competitive rates.

Apply for Lines of Credit

The process of applying for a line of credit is not a complex one. The lender just needs to understand your credit score, current income streams, and the other loan facilities that your have. Most companies feed all this information in a system and it will give you a score automatically.

Lines of Credit Loans for Bad Credit

With an active income stream, we can give you our lines of credit even if you have a bad borrowing history. It is one of the things that will help you improve your credit score and get more loan facilities.

Lines of Credit for New Business

We have so many new businesses in the region that have grown significantly because of the lines of credit that we give to them. You can also change your story by becoming our customer today.

Lines of Credit for New Businesses

When opening a new business, you can still get a line of credit to help you when you will require some urgent working capital. We use the other income streams and what your ability can generate to give you a limit. Therefore, you will not miss on any upcoming business opportunity because of lack of funds.

Lines of Credit on Investment Properties

If you have an investment property, we can use its proceeds to process your lines of credit. The limit that we give you depends on the income that your real estate property generates.

Business Lines of Credit Interest Rates

The rates that we charge for business lines of credit are more affordable than any other brand in the market. Therefore, you should not allow someone to cheat you that this credit option is expensive. It is one of the best solutions especially if you find yourself in a crisis.

Lines of Credit Near Me

Sometimes going for lines of credit near me is the best option. We have the largest number of clients in the region because we are a listening a caring financial partner.

Best Personal Lines of Credit

If you want personal lines of credit, it is advisable to get one from us. We take a very short period to process your request. Besides, our terms are more favorable than what the other lenders in the market offer to their clients.

How Lines of Credit Work

You should not take a line of credit unless you understand how it works. Once you submit your application, the lender will give you a limit depending on your income, current loans, and credit score. You can use any amount that you wish at any time but you will never exceed the limit. The interest is only charged on what you take. If you discover that your ability to pay has improved, you can submit a request to the borrower to increase your limit.

How to Get Funding for a Business

It is very easy to get funding for a business as long as you contact a reputable lender. Our company is always willing to fund business people and see them grow. We have different types of business loans and you can choose any of them depending on the type of business that you run.

How to Get Funding to Start a Business

Getting funding to start a business is not a hard thing. Come with your business plan to us and if the idea is viable, we will give you a loan application form. It takes us very few days to process your business loan. You will also get an opportunity to meet potential customers, suppliers, investors, business partners, and other stake holders.

How to Get Funding for Startup

There are two main considerations when you want to get funding for a startup. The first one is proof of business and it should be legit. The second one is the ability of your new business to repay the loan. Once you have this in place, you can come to us and we will give you a startup loan.

Best Funding Options

The best funding options for your business are with our brand. The company has tailor-made products that will meet your needs with the desired level of accuracy. Once we understand your needs, we will be able to match it to a perfect product.

Entrepreneur Funding

We cover all entrepreneurs in our region when it comes to funding. The amount of loan or your industry will not make us to discriminate against you. SoFlo funding has been walking with so many entrepreneurs through this journey of success.

Funding for Entrepreneur

We offer the best funding programs for entrepreneurs in our contemporary society. All our products are tailor-made to match with your sales patterns perfectly. This explains why you will rarely come across people defaulting our loans.

Social Entrepreneur Funding

Social entrepreneurs have a special place in our contemporary society. If you are one of them, we have you covered in terms of funding. You can get loans from our company so that you can use these proceeds to fund your activities.

Business Capital Loans

A business that has sufficient capital will not struggle with liquidity issues. It also becomes much easier for such a brand to grow. It is for this reason that we allow you to come for capital loans for your business from our company. The rates are quite affordable and you will not have a hard time in meeting your obligation as a borrower.

Capital for Small Business

The capital demand for small businesses may not be high but it is very crucial. Financial struggles can make your brand to lose trust from all the stake holders. Our brand offers affordable capital offers to small businesses you should not miss out on them.

Working Capital for Small Business

The primary determinant of the success of small businesses is the availability of working capital. We want to make sure that your business is flourishing by lending you sufficient funds to buy stock. The company has flexible payment options and hence you will not struggle in any way.

Small Business Funding

We take a very flexible approach in business funding. The most important thing is to come up with a schedule that matches your business patterns. This makes sure that you don’t struggle as you repay your loan.

Small Business Funding for Startups

All that a small business need is funding and industry related tips to grow. Apart from the loans, we have financial experts who will guide you through the process of running the business. Our desire is to walk with you because as your business grows, you will continue to take bigger loans with us which means we will also grow.

Small Business Funding Start-Up

If you have a feasible business idea, we will lend you the funds to use in establishing the startup. As the business continues to grow, you will be able to acquire bigger loans.

Small Business Funding Options

Most of the corporate organizations you are seeing out there begin as small businesses. The secret is using the available small business funding options. SoFlo Funding is the best option if you want great loan deals for your business.

How to Get Small Business Funding

It is not hard to get small business funding as long as your brand is legit. We will analyze your daily sales and give you an amount that will help you to grow into a big brand.

Small Business Funding Companies

Not all lenders in the region provide loan facilities for small companies. What you need to understand is that small companies have a lot of potential but face liquidity issues. As a result, we give loans to small companies at rates that are highly competitive.

Business Credit Line

We have the best loan limits and interest rates for business credit lines in the region. This explains why our company commands the region when it comes to customers who use business credit lines.

Business Credit Builder

The business credit builder gives borrowers an easy way of disputing and fixing harmful and inaccurate information on their business reports. It helps you in building a stronger business credit score and profile so that most lenders can approve your loan. Do not suffer from negative credit scores especially if it is not your fault.

How to Build Business Credit

The best way to build your business credit is by clearing your debts on time. If you have overdue accounts, make sure you clear them in good time. For people with a bad credit history, taking smaller loans and clearing them on time will help improve your credit score. Lenders will trust you more and start to give you bigger loan amounts.

Funding for Startup Business

Most of the startup businesses struggle because of the lack of funds but this should not be the case. However, this should not be the case especially to people who have a significant contribution to our society. We have exemplary loan products that meet the needs of startups with a very high level or precision.

Funding for Entrepreneurship

Entrepreneurs is all our economy needs to be able to move to the next level. Therefore, it is good for such people to be supported when joining any line of business. Our company has excellent loan products for the upcoming and experienced entrepreneurs in the region.

Funding for Startup Nonprofits

Most nonprofit startups find it hard to get funds for their business. However, these institutions have a special function to play in our contemporary society. If you are planning to startup any nonprofit, feel free to come to us and we will be able to help you with the required funds.

Funding for Startup Restaurants

To start a restaurant, you need a lot of money to buy the desired equipment, stock, and even pay rent. It is very hard to meet these obligations especially when starting. This forms our decision to fund restaurants that are starting up.

Funding for Social Entrepreneurs

Social entrepreneurs provide solutions for cultural, social, and environmental issues that human beings face. These are very special people in our contemporary society and that is why we include them on the businesses that we fund.

Funding for Tech Startup

Tech is the way the whole world is going and you can never go wrong as long as you choose your business wisely. Therefore, it is one of the industries that we are keen at funding to see you move to the next level.

Funding for My Startup

Not all lenders in the region will be willing to provide funding for your startup. Some of them feel that it is tricky because there are no business records to inform their decision. However, it will become much easier especially if you have a secondary source of income. Our experts have the right experience in the region and industry to determine the right loan amount for your startup.

Restaurant Funding

The number of customers that you have in your restaurant virtually depends on your ability to serve them. It is good to go for restaurant funding as long as it will increase your capacity.

Funding for Restaurant Startup

So many successful restaurants in the United States rely on loans. You will have more customers once you have the ability to meet all their needs. For restaurant startup, you can always come to us for the desired funding.

Funding for Gyms

Most people who own gyms in the region run to us for funding. Once you have modern equipment on your gym. You will begin to experience an influx of customers. Therefore, it will not be business as usual when you begin to use our funding for gyms.

Funding for Yoga

If you need yoga equipment for personal or business use, we have a special package to cover your needs. The cost of the equipment is not an issue because we have the capacity to fund you whatsoever.

Funding for Fitness Programs

Are you in the processor of looking for funding for fitness programs? We are here to help you out. Our company can fund virtually all types of fitness programs. Therefore, don’t stay unfit because of the lack of funds yet you can afford to service a loan. SoFlo Funding will make sure that you are running on schedule for all your fitness program.

Looking for a first-class financing solutions company?

Here at SoFlo Funding, we love educating you on the funding process, whether you are a startup or an established business. So below are two of our preferred funding partners that we highly recommend. Fundwise Capital and David Allen Capital have provided the top funding solutions for thousands of entrepreneurs nationwide. You can read about them by clicking either of the two buttons below

Below are some of the loan products that you will get from our company:

- Startup Funding

- Startup Funding for Business

- Startup Funding for Small Business

- Startup Funding Website

- Startup Funding For Nonprofits

- Startup Funding For Companies

- Startup Funding Options

- Startup Funding Sources

- Startup Funding Stages

- Startup Funding Online

- How Startups Get Funding

- Business Funding

- Business Funding For Startups

- Business Funding Solutions

- Business Funding With Bad Credit

- Business Funding Fast

- Small Business Funding

- Business Funding Partners

- Business Funding For Veterans

- Business Funding Group

- Business Funding Capital

- Small Business Loans

- Small Business Loans For Woman

- How to Get Small Business Loans

- Small Business Loans for Startups

- Small Business Loans for Veterans

- Small Business Loan Rates

- Small Business Loans Near Me

- Rates for Small Business Loans

- Small Business Loans for Minorities

- How Do Small Business Loans Work

- Small Business Loans New Business

- Small Business Loans Online

- Small Business Loans for Disabled Veterans

- Qualifications for Small Business Loans

- Small Business Loans Unsecured

- Where to Get Small Business Loans

- Small Business Loans Quick

- Small Business Loans Companies

- Small Business Loans Amount

- Unsecured Loans

- Unsecured Loans Personal

- Unsecured Loans vs Secured

- Unsecured Loans for Business

- Unsecured Loans Online

- Unsecured Loans Debt Consolidation

- Unsecured Loans to Consolidate Debt

- Unsecured Loans Rates

- Rates for Unsecured Loans

- Unsecured Loans Near Me

- Unsecured Loans Interest Rates

- Unsecured Loans for Veterans

- Unsecured Loans Types

- Unsecured Loans Best Rates

- Unsecured Loans Low Interest

- Unsecured Loans Companies

- Creative Financing

- Creative Financing Options

- What is Creative Financing

- Creative Business Financing

- Creative Financing Ideas

- Creative Financing Strategies

- Creative Financing Solutions

- Real Estate Investor Loan

- Real Estate Investor Financing

- New Venture Funding

- Secured Loans

- Secured Loans Online

- Secured Loans for Bad Credit

- Secured Loans with Bad Credit

- Secured Loans for Business

- Secured Loans vs. Unsecured Loan

- Secured Loans Rates

- How Does Secured Loans Work

- Secured Loan Debt Consolidation

- Secured Loan Collateral

- Secured Loans Types

- Startup Business Loan Bad Credit

- Startup Business Funding

- Business Funding for Startup

- Startup Business Loan Rates

- How to Get Startup Business Funding

- SBA Loans

- SBA Loans Requirements

- Fundwise Capital

- SBA Loans Rates

- SBA Loans 504

- SBA Loans Disaster

- SBA Loans for Veterans

- SBA Loans for Women

- SBA Loans Business

- SBA Loans Interest Rate

- Terms for SBA Loans

- SBA Loans Real Estate

- SBA Loans Types

- SBA Loans for Small Business

- SBA Loans Programs

- SBA Loans Application

- MCA Loans

- MCA Business Loans

- Merchant Cash Advance

- Merchant Cash Advance Companies

- Merchant Cash Advance Loan

- What is Merchant Cash Advance

- Merchant Cash Advance Bad Credit

- Shark Loans

- Shark Loans Online

- Shark Loans Bad Credit

- Funding for Companies

- Funding Companies

- Funding Companies for Startups

- Funding for Small Companies

- Business Lines of Credit

- Lines of Credit for Business

- Lines of Credit Loans

- Lines of Credit Personal

- Lines of Credit for Small Business

- Lines of Credit Online

- How do Lines of Credit Work

- Equity Lines of Credit Rates

- Lines of Credit Rates

- Interest Rates for Lines of Credit

- Lines of Credit vs. Loan

- How to Get Lines of Credit

- Business Lines of Credit Rates

- Apply for Lines of Credit

- Lines of Credit Loans for Bad Credit

- David Allen Capital

- Lines of Credit for New Business

- Lines of Credit for New Businesses

- Lines of Credit on Investment Properties

- Business Lines of Credit Interest Rates

- Lines of Credit Near Me

- Best Personal Lines of Credit

- How Lines of Credit Work

- How to Get Funding for a Business

- How to Get Funding to Start a Business

- How to Get Funding for Startup

- Best Funding Options

- Entrepreneur Funding

- Funding for Entrepreneur

- Social Entrepreneur Funding

- Business Capital Loans

- Capital for Small Business

- Working Capital for Small Business

- Small Business Funding

- Small Business Funding for Startups

- Small Business Funding Start-Up

- Small Business Funding Options

- How to Get Small Business Funding

- Small Business Funding Companies

- Business Credit Line

- Business Credit Builder

- How to Build Business Credit

- Funding for Startup Business

- Funding for Entrepreneurship

- Funding for Startup Nonprofits

- Funding for Startup Restaurants

- Funding for Social Entrepreneurs

- Funding for Tech Startup

- Funding for Female Entrepreneurs

- Funding for My Startup

- Restaurant Funding

- Funding for Restaurant Startup

- Funding for Gyms

- Funding for Yoga

- Funding for Fitness Programs